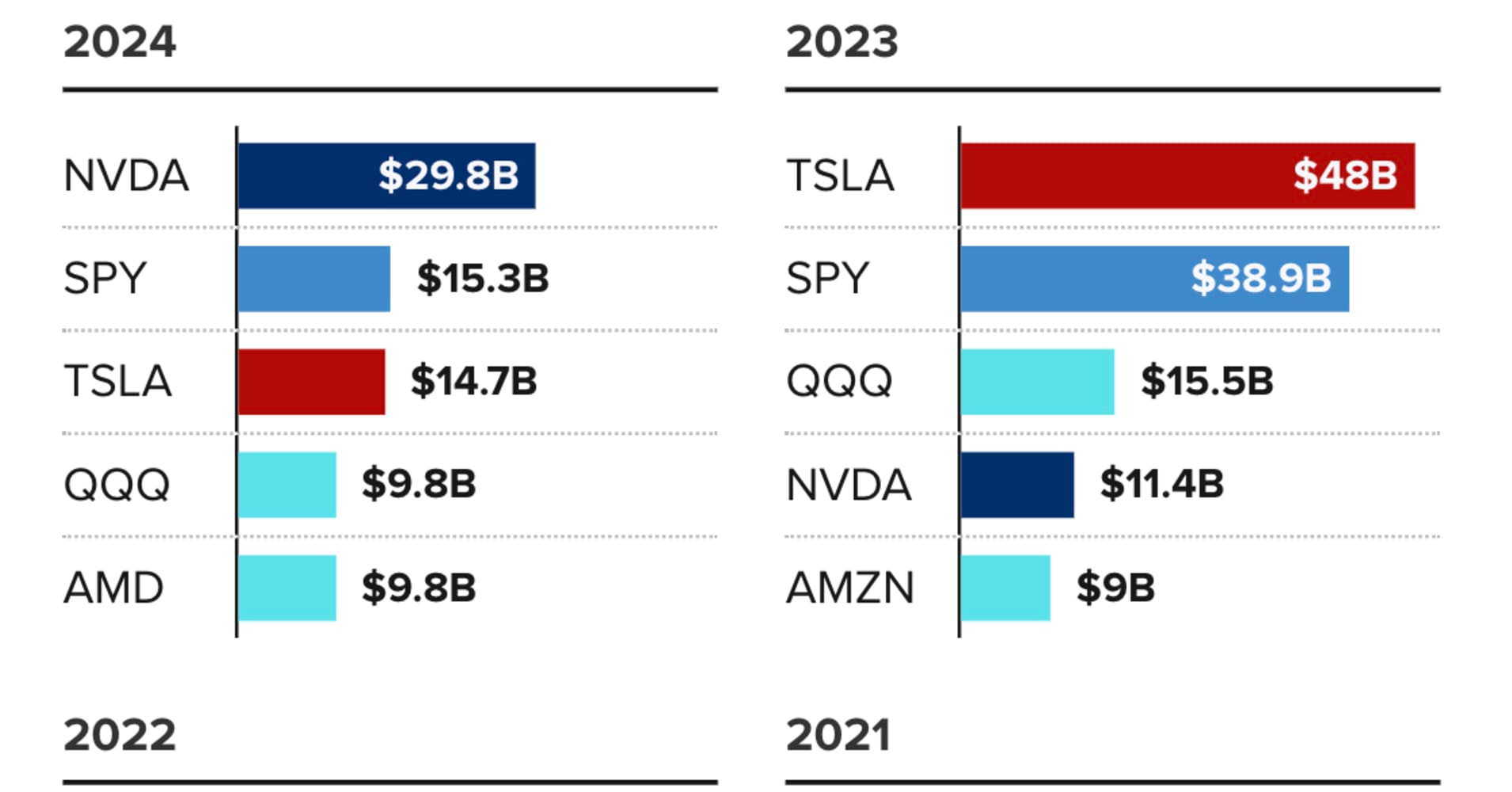

Retail investors have demonstrated unprecedented interest in Nvidia throughout 2024, with individual traders investing approximately $30 billion into the semiconductor company’s stock, according to Vanda Research data as of December 17.

The chipmaker has attracted nearly twice the net inflows from retail investors compared to the SPDR S&P 500 ETF Trust (SPY), positioning it to surpass Tesla as the most popular retail investment of the year. The company’s stock has gained over 180% in 2024, cementing its position among companies with market capitalizations exceeding $3 trillion and becoming the second-most valuable company in the United States.

Individual investors like Michael MacGillivray, 25, from Michigan, have been drawn to Nvidia’s dominant position in artificial intelligence. “Whenever you look at AI, it’s like, all the roads lead to Nvidia,” said MacGillivray, who has invested thousands of dollars in the company this year.

The stock’s prominence in retail portfolios has grown significantly, now representing over 10% of the average individual investor’s holdings, up from 5.5% at the beginning of 2024. This represents an 885% increase in retail net inflows compared to three years ago.

Retail investment surges have coincided with Nvidia’s earnings reports, with additional buying activity during market dips, such as in early August. The company’s recent addition to the Dow Jones Industrial Average has further validated its market position.

However, the stock has experienced some cooling in recent months. D.A. Davidson’s head of technology research, Gil Luria, noted that while the stock was more expensive six months ago, it has now reached more “balanced” and “reasonable” levels, despite continuing to exceed Wall Street’s earnings expectations.

The enthusiasm for Nvidia has extended beyond digital trading, with investors organizing events such as an earnings report watch party in New York City in August. This followed the company’s 10-to-1 stock split, a move often aimed at attracting retail investors.

Morningstar equity strategist Brian Colello observed that Nvidia exhibits significant volatility for a company of its size, noting, “It’s jaw-dropping at times that such a large company can have such a big move in the stock price on any given day.”

Looking ahead, Palantir has emerged as another retail investor favorite during the fourth quarter, ranking as the ninth most-bought security in 2024, surpassing tech giants like Amazon, Alphabet, and Microsoft. The company’s stock has increased by approximately 380% in 2024, leading the S&P 500’s performance.

Individual investors like Genevieve Khoury, a social media marketer, represent the growing demographic of retail traders. Khoury, who began investing in Nvidia in 2022 on her father’s recommendation, plans to maintain her position for future significant purchases. Similarly, recent college graduate Prajeet Tripathy remains optimistic about Nvidia’s AI leadership and innovation potential.

The trend of individual stocks outpacing broad market ETFs in retail investment continues for the second consecutive year. However, Vanda’s senior vice president Marco Iachini notes that substantial inflows to the SPY ETF suggest investors aren’t abandoning diversified investment strategies, but rather participating in the ongoing bull market through targeted technology investments.

Be the first to leave a comment